In an era where AI is reshaping the world's underlying structure, what is truly scarce is electricity and computing power.

Professional Team

Director of Investment Research | Zeng Duo Mr. Zeng Duo graduated from Wuhan University with a major in Electrical System Automation. Early in his career, he worked at a provincial power design institute, serving as a registered electrical engineer and a first-class construction engineer. He served as the chief engineer for multiple power transmission and transformation projects, deeply involved in power grid planning, power system design, and engineering implementation. After immigrating to Canada, Mr. Zeng obtained an EMBA from the University of Toronto, gradually combining his engineering background with the financial system to enter the field of asset management and cross-market investment. He has accumulated over twenty years of practical experience, winning numerous awards in global public market research and strategy competitions, demonstrating his ability in cross-asset and cross-market strategy analysis, derivative structure design, and risk awareness. In recent years, he has further focused his research on the deep coupling relationship between North American energy structure, grid connection systems, and computing infrastructure, systematically introducing engineering and power system knowledge into the asset allocation framework, forming a cross-cycle investment system based on physical energy and driven by computing demand.

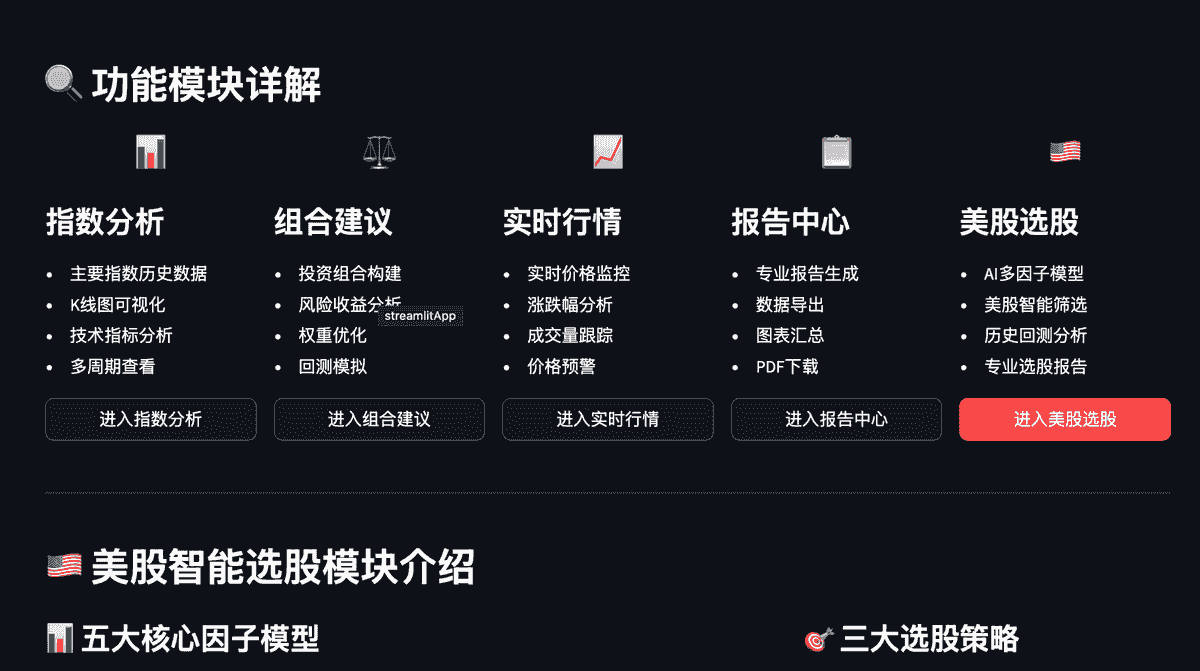

JDV Securities Intelligent Analysis System

① Intelligent Stock Selection: Based on a self-developed multi-factor quantitative model, combined with AI, it screens high-quality US stocks in real time and supports complete backtesting and factor decomposition, ensuring full traceability of the stock selection logic.

② Portfolio Optimization: Inputting a target stock provides: optimal weight allocation, risk exposure structure, expected return range, and scenario stress test results, helping to build an executable investment portfolio.

③ Real-time Market Monitoring: Automatically updates prices, trading volume, hot sector rotation, and capital flows.

④ Professional Investment Research Reports: One-click generation of systematic research reports: Market trends, factor status, portfolio performance, risk diagnosis, and investment commentary are all automatically generated in a professional format and can be used directly externally.

About Us

JDV Capital, headquartered in Montreal, Canada, is a privately held platform specializing in long-term structural research on energy and computing infrastructure. We focus on the deep relationship between North American energy quotas, computing infrastructure, and digital infrastructure, researching their long-term value, scarcity, and competitive advantages across different cycles. The founder is a licensed securities and asset management representative certified by the Hong Kong Securities and Futures Commission, holding four types of licenses (1, 4, 6, and 9) (securities trading, investment advisory, institutional finance, and asset management), and is skilled in cross-border asset allocation. The company utilizes its own funds to participate in research and operations of public market and institutional instruments, primarily covering North American energy and computing infrastructure-related funds, private bonds, and secondary market targets for internal research and capital market awareness presentation. Shareholders can access the analysis process and research results through internal channels.

Why Us

Penetrating Physical Risk Identification Capabilities

Leveraging years of experience in power engineering, we penetrate the physical dimensions of power grid connection agreements, transformer delivery cycles, and regulatory red lines to identify genuine projects. When the market is speculating on hype, we only select truly structurally scarce computing power nodes.

Internal Channels and Bridging Capabilities for Scarce Quotas

With years of experience in the North American energy system, we possess exclusive channels for accessing top-tier institutional non-public offerings. Through our internal network, we secure approved, non-replicable computing power quota claims with a strong "physical moat" for our clients.

Cross-Cycle "Engineering-Grade" Risk Control Framework

We translate rigorous power engineering logic into a financial investment framework. Instead of chasing short-term trends, we build cross-cycle portfolio strategies based on verifiable power load data, combining the security of physical collateral with financial leverage.

How We Invest

The core layer selects key power nodes for North American computing centers through non-public institutional channels. Addressing the physical bottlenecks of "difficult grid connection and limited quotas" in North America, it locks in scarce power resources, building a long-term, predictable cash flow foundation and providing a security barrier for the portfolio.

The satellite layer proactively deploys energy-self-sufficient data centers and computing infrastructure. These assets, through deep coupling of power and computing power, capture the structural premium brought by the growth in AI demand, while hedging against energy price fluctuations.

All underlying configurations are based on regulated public market instruments or managed SPV architectures, ensuring clear assets, controlled funds, and transparent processes. Every investment is backed by physical assets and has a verifiable compliance path.

MISSION&VISION

Mission: Leveraging a deep industry background and experience in key North American power nodes, we transform the physical energy quota identification capability into a tangible investment foundation, helping partners lock in core computing power hubs and participate in structural growth opportunities in the AI era.

Vision: To build a world-leading private strategy platform for computing power infrastructure, becoming a bridge between the physical energy lifeline and top-tier capital channels, providing scarce opportunities and long-term cognitive advantages.

Contact

Add:3 Pl. Ville-Marie Suite 400, Montreal, Quebec H3B 2E3 Tel:1-514-813-3989 Email:info@jdvcap.com

平衡当下 远见未来

zengduo@jdvcap.com

001-514-813-3989

Legal Disclaimer / Risk Notice

Nature of Information: All content provided by the Company is intended solely for internal shareholders and a strictly limited network of close business associates. This information is for informational and educational purposes only and does not constitute investment advice, a financial promotion, an offer to sell, or a solicitation of an offer to buy any securities or financial instruments.

Illustrative Purpose: Any historical strategies, asset allocations, historical yields of private placements, competition results, or research case studies mentioned are presented solely to illustrate the Company’s analytical methodologies, asset recognition capabilities, and strategic channel resources. They are not indicative of future results and must not be construed as a promise or guarantee of specific returns.

Regulatory Compliance: All transactions and management activities involving securities, funds, or structured products are executed exclusively through appropriately licensed and regulated financial institutions in their respective jurisdictions. Shareholders and collaborators are responsible for ensuring their own compliance with applicable local laws and regulations and should conduct their own independent due diligence.

No Warranty & Risk Acknowledgment: The Company makes no warranties, express or implied, regarding the completeness, accuracy, or timeliness of the information provided. Investing in energy and computing infrastructure involves significant risks, including but not limited to market volatility, regulatory changes, and liquidity constraints. Past performance is not a reliable indicator of future outcomes.